Evergrande Default Risk

A default by Evergrande could lead to. This puts at risk the Chinese real estate market which accounts for about 15 of the countrys GDP.

China Evergrande S Rising Default Risks Shift Focus To Possible Beijing Rescue Euronews

An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of.

Evergrande default risk

. Default alarms put thousands of suppliers jobs and economy at risk as developers IOUs balloon. Evergrande is heading for default. Beijing leaves Evergrande heading for default. In a crisis that has shaken the Chinese as.This week Evergrande will officially default if you do not pay interest on US dollar-denominated offshore bonds. Cash-strapped property group China Evergrande Group 3333HK said on Tuesday it has engaged advisers to examine its financial options and warned of default risks. The company has been silent about coupon payments for the other four bonds that have expired in the last few weeks. Evergrande makes overdue coupon payments for offshore bonds staves off default Fed highlights Evergrande spillover potential as a significant risk High-yield dollar bonds issued by Chinese.

China Evergrande warns of default risk if it fails to sell assets. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of. Investors assess risks of likely default. Both bonds would default if Evergrande fails to settle the interest within 30 days of the scheduled payment dates.

The most far-reaching consequence could be due to the money the firm owes to nearly 128 banks and 121 non-banking institutions. Yesterday it was due to repay 835m in interest accrued on offshore bonds. Evergrande NEV has unveiled nine models and spent billions. Most recently the company secured a three-month extension.

Crisis at Chinese property developer threatens the bond market housing market and wider economy. For now the company is looking to secure an extension for its debts as well as other alternative arrangements. Evergrande the second-largest developer in China by sales has warned twice it could default setting off investor worries. The crisis facing the Chinese property giant has materialized as the company has failed to pay coupons to its investors that were due yesterday.

Evergrande has warned it risks defaulting on its debt if it fails to raise cash as Chinas most heavily indebted property developer battles to stave off an unfolding liquidity crisis. In October 2019 China Evergrande Groups first project in Hong Kong got off to a flying. Evergrande has debts of more than 300bn 2 of Chinas GDP. Evergrande will default on both the bonds if its fails to settle the interest within 30 days of the payments becoming due.

The due date is late September but there is a 30-day grace period. Aug31 -- China Evergrande Group warned that it risks defaulting on borrowing if its all-out effort to raise cash falls short rattling bond investors in the. Still Citi said that while Evergrandes default crunch was a potential systemic risk to Chinas financial system it was not shaping up as Chinas Lehman moment. Evergrande is about 300 billion in debt and it is believed that it wont be able to comply with all its financial obligations.

File photo NEW DELHI. The third of a three-part series on China Evergrande Group takes a deep dive into how the property developers debt crisis is affecting thousands of suppliers across the construction furnishings and real estate services sectors and how the fallout of an Evergrande collapse could affect Chinas economy. Which debts are at risk of default. Total liabilities rise despite developers efforts to pare back debts.

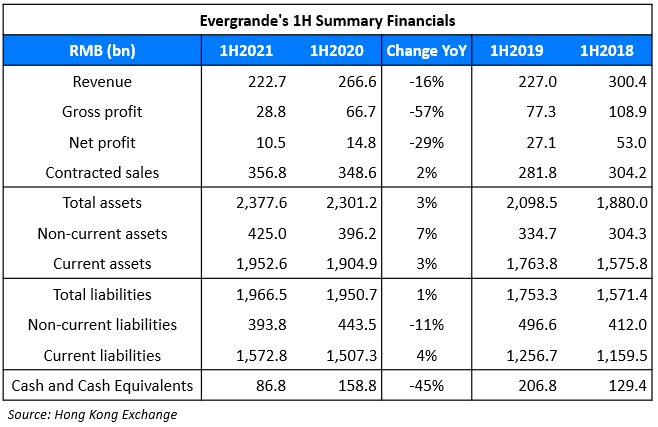

At the end of June Evergrande had debts of Rmb572bn 89bn including loans from banks and borrowings from bond markets within and beyond China.

If Evergrande Defaults What Can Its Offshore Creditors Do Asia Financial News

China Evergrande Warns Of Default Risk If It Fails To Sell Assets Nikkei Asia

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Embattled China Evergrande Warns Of Cross Default Liquidity Crunch Euronews

China S Evergrande Group Warns Of Cross Default Risk

China Evergrande Warns Of Default Risk Rising Litigation Cases

Evergrande Default Risk Draws Attention To Potential Beijing Bailout California18

Evergrande At Risk Of Default Prepare For The Worst The Cryptonomist

Posting Komentar untuk "Evergrande Default Risk"