Evergrande Default Risk

This implies that Evergrande will probably be unable to cover about 83 million in interest payments by Saturday increasing the risk of default. But whether a missed payment on the part of subsidiaries would directly constitute a default at the Evergrande level would depend on whether there is a guarantee relationship.

China Evergrande Warns Of Default Risk If It Fails To Sell Assets Nikkei Asia

It said that if it cant repay its debt it may lead to a situation of cross default where a.

Evergrande default risk

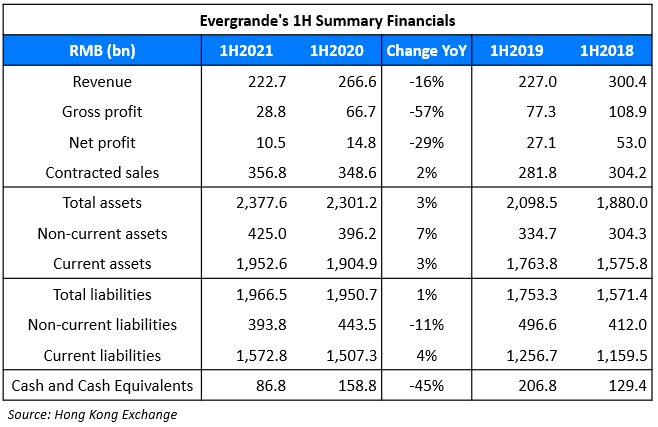

. Business Chinas Evergrande default risks spook global markets. BTC is sovereign credit insurance long volatility with no counterparty risk. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41. The firms liabilities involved as.Debt troubles at the property group have been dragging down global markets as investors assess the implications of a. At the end of June Evergrande had debts of Rmb572bn 89bn including loans from banks and borrowings from bond markets within and beyond China. The firms liabilities involved as many as 128 banks and over 121 non. Chinas central bank said in 2018 companies including Evergrande might pose systemic risk to Chinas financial system.

An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41. Didnt Evergrande go into default. Size Of Potential Default. Cash-strapped property group China Evergrande Group said it has engaged advisers to.

After Chinas property giant Evergrande Group faced a debt repayment deadline another real estate developer Kaisa Group is at risk of default escalating fears of further problems in the countrys embattled property sector. Evergrande warns of growing default risks as pressures mount. Default alarms put thousands of suppliers jobs and economy at risk as developers IOUs balloon. Evergrandes project companies which are subsidiaries might have interest payments on banks loans due before Sept.

TOKYO As distracting as the default drama looming over China Evergrande Group may be the one percolating in Washington is by far the more existential of the two. HONG KONGNEW YORK Persistent default fears eclipsed efforts by China Evergrande Groups chairman to lift confidence in the embattled firm on Tuesday as Beijing showed no signs it would intervene to stem any domino effects across the global economy. Many debt payment contracts have a 30-day grace period. In a crisis that has shaken the Chinese as.

In the context of recent meaningful global defaults the Evergrande debt is not overly concerning. The most far-reaching consequence could be due to the money the firm owes to nearly 128 banks and 121 non-banking institutions. Chinas central bank said in 2018 companies including Evergrande might pose systemic risk to Chinas financial system. Total liabilities at Evergrande are 300 billion of which 200 billion is pre-payments for housing from Chinese.

Dont overthink this. Evergrande will default on both the bonds if its fails to settle the interest within 30 days of the payments becoming due. On Tuesday Evergrande said its at risk of a cross default which means such risks could spill into other related. Shares of Kaisa Group a Shenzhen-based developer were suspended from trading on Friday in Hong Kong.

Evergrande warned this week its escalating troubles could lead to broader default risks. Evergrande the worlds most indebted developer which once epitomised a freewheeling era of borrowing and building has been stumbling from deadline to. File photo NEW DELHI. Which debts are at risk of default.

China Evergrandes rising default risks shift focus to possible Beijing rescue. US default a greater risk than Evergrande meltdown. Evergrande had been trying to sell 501 of its property services to its competitor though the talks ended up falling through. A default is likely.

That condition is referred to as a default. One of the key concerns over Evergrande was that they would be unable to make their debt payments. The risk of a US debt default is being overlooked by Chinas deflating property market. Evergrande has warned it risks defaulting on its debt if it fails to raise cash as Chinas most heavily indebted property developer battles to stave off an unfolding liquidity crisis.

A default by Evergrande could lead to. However its a more complicated process than a company simply not making a payment. The company warned investors twice in as many weeks that it could default. Cash-strapped property group China Evergrande Group 3333HK said on Tuesday it has engaged advisers to examine its financial options and warned.

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

China S Evergrande Default Risk Worries Investors

/cloudfront-us-east-2.images.arcpublishing.com/reuters/65B7QMZXSVISHAHFEJEH6WDSAA.jpg)

Explainer How China Evergrande S Debt Woes Pose A Systemic Risk Reuters

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Evergrande Crisis Why The Chinese Property Developer Faces Risk Of Default

China S Evergrande Default Risk Weighs On Global Markets Here S Why

Evergrande Default Risk Draws Attention To Potential Beijing Bailout California18

China Evergrande Warns Of Default Risk Rising Litigation Cases

Posting Komentar untuk "Evergrande Default Risk"